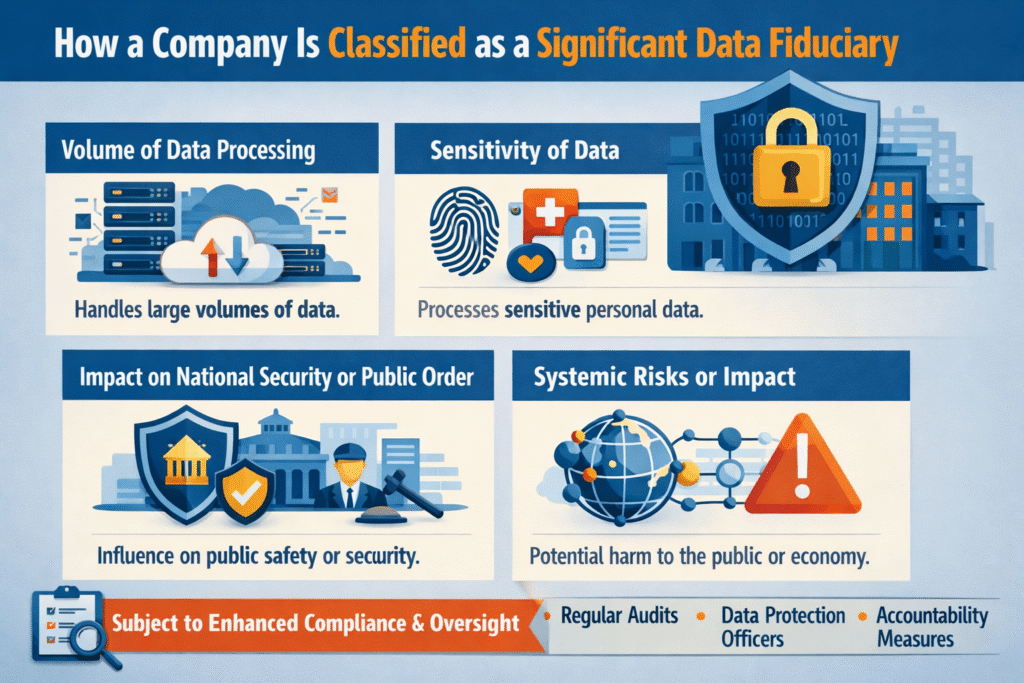

SDF status is not automatic and not self-declared. It is determined by the government based on several risk-based factors.

While the exact thresholds may evolve, the DPDP Act outlines clear criteria that signal higher risk.

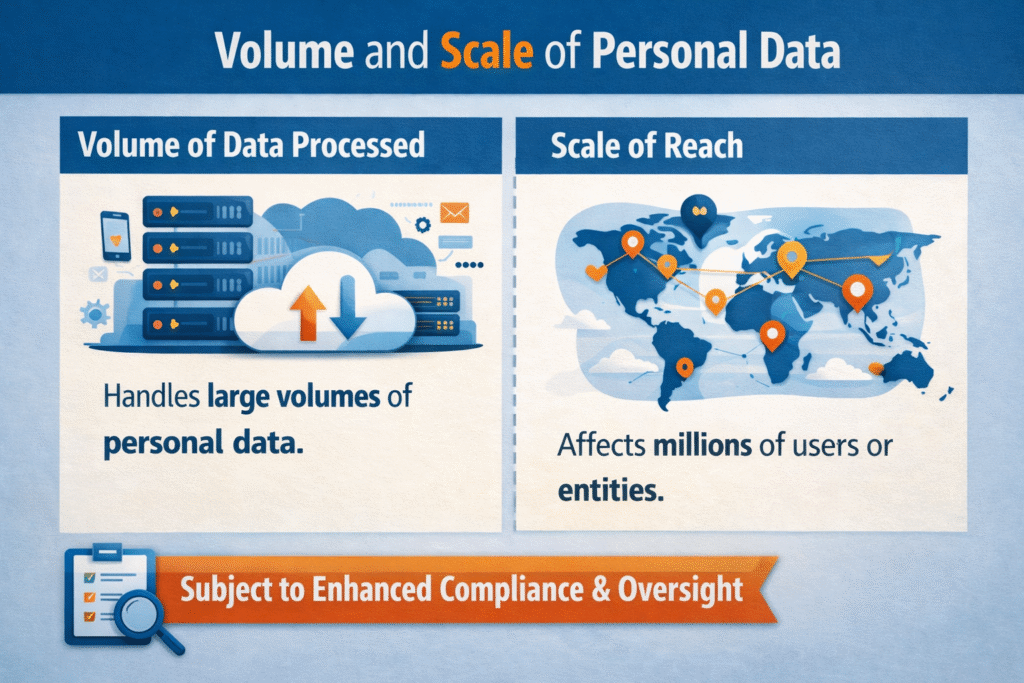

1. Volume and Scale of Personal Data

The most obvious factor is volume.

Companies that process large amounts of personal data across millions of users naturally amplify the impact of any failure. A single misconfiguration or misuse can affect entire populations.

This includes platforms that:

Operate at national scale

Collect continuous user data

Retain data for long durations

Aggregate information across services

At scale, even small mistakes stop being small.

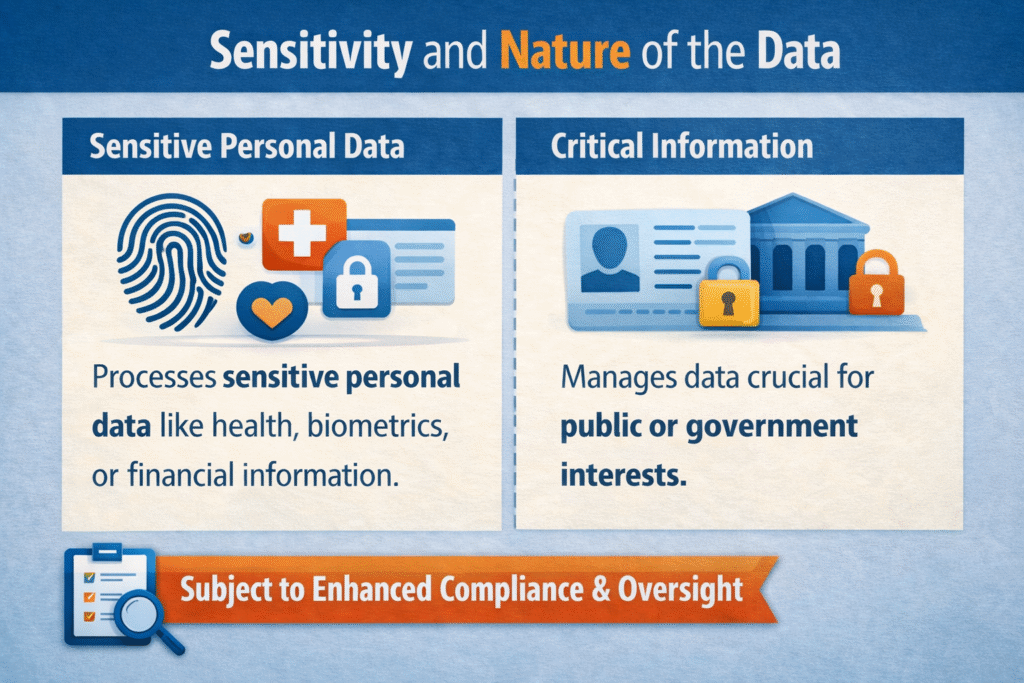

2. Sensitivity and Nature of the Data

Not all data carries equal risk.

Organizations dealing with:

Financial data

Health information

Biometric identifiers

Location tracking

Children’s data

operate in a higher-risk zone, regardless of company size.

The DPDP Act recognizes that misuse or leakage of sensitive data can cause long-term harm that cannot be undone with apologies or refunds.

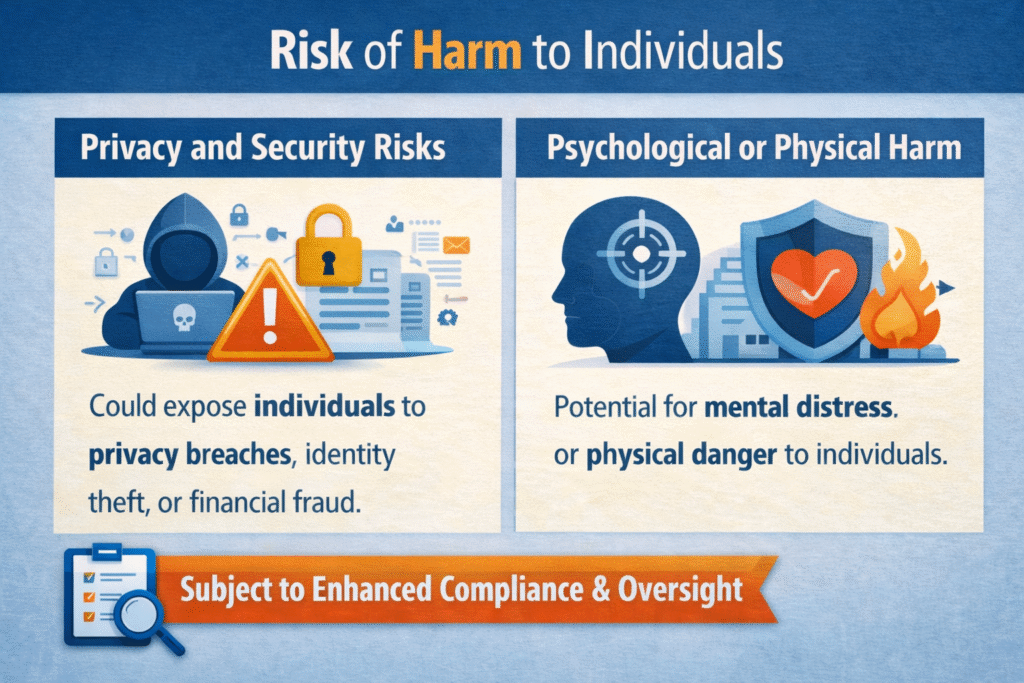

3. Risk of Harm to Individuals

Beyond categories of data, regulators look at consequences.

Can your data practices:

Enable profiling or surveillance?

Influence behavior at scale?

Expose individuals to discrimination or manipulation?

If your systems shape outcomes rather than merely record information, the risk calculation changes.

4. Impact on Public Order and Democracy

This is where the SDF concept becomes especially significant.

Platforms that:

Shape public discourse

Influence political opinions

Amplify information at scale

Use recommendation or ranking algorithms

can affect more than just individual users.

The DPDP Act explicitly acknowledges that certain data-driven systems can impact democratic processes, public trust, and social stability. When data power meets influence, accountability tightens.

5. Use of New or Emerging Technologies

Companies deploying advanced technologies such as:

Artificial intelligence

Automated decision-making

Behavioral analytics

Large-scale profiling systems

are also more likely to fall within SDF consideration.

The concern is not innovation itself, but opacity. When decisions are automated and difficult to explain, the risk to user rights increases.

What Changes Once You Are Classified as an SDF

SDFs are subject to enhanced compliance obligations designed to match their higher risk profile.

These include:

Appointment of a dedicated Data Protection Officer

Periodic independent data audits

Data Protection Impact Assessments for risky processing

Stronger governance and accountability frameworks

These are not symbolic requirements. They exist to force visibility into systems that might otherwise operate unchecked.

Why Startups Should Pay Attention Early

A common misconception is that SDF rules only apply to large corporations.

In reality, growth trajectories matter more than current size.

A startup can move into SDF territory quickly by:

Scaling user base rapidly

Entering sensitive sectors like fintech or healthtech

Building AI-driven personalization systems

Becoming an infrastructure layer for other businesses

By the time classification happens, retrofitting compliance becomes expensive and disruptive.

SDF Status Is About Risk, Not Revenue

One important point often missed is that revenue is not the deciding factor.

A company can be profitable and low-risk, or loss-making and high-risk. What matters is data power and societal impact, not balance sheets.

This reframes compliance as a design question, not just a legal one.

The Strategic Opportunity in SDF Readiness

While SDF obligations are heavier, they also create an opportunity.

Organizations that build strong governance early:

Gain trust faster

Face fewer regulatory shocks

Scale with fewer legal roadblocks

Signal maturity to partners and regulators

Being SDF-ready is not about fear. It’s about foresight.

Final Thought

The SDF framework reflects a broader truth embedded in the DPDP Act:

The more influence your data systems have, the more carefully they must be governed.

If your company processes data at scale, shapes decisions, or influences public behavior, it’s worth asking the uncomfortable question early.

Not “Are we an SDF today?”

But “What happens if we become one tomorrow?”

That question, asked in time, can save years of reactive compliance later.