Online Fraud & Financial Scams

Online fraud has become one of the fastest-growing cyber threats in India. Every day, people lose money to fake calls, phishing links, investment scams, OTP frauds, and social-engineering tricks. The purpose of this page is to help you understand how these scams work, how to identify early warning signs, and what to do if you ever fall victim to one.

What Is Online Financial Fraud?

Fraudsters often pretend to be:

- Bank Representatives

- Customer Care Executives

- Government Officers

- Delivery Agents

- Online Sellers or Buyers

- Investment Advisors

Their goal is simple: gain your trust, force a quick decision, and steal your money.

Common Types of Online Financial Scams

1. Phishing Scams

Scammers send fake emails, SMS, or WhatsApp messages that look like they’re from your bank or a trusted company. These messages usually contain urgent warnings or clickable links that steal your login details.

Red flag: Links asking you to “update KYC” or “verify your account immediately.”

2. UPI & OTP Fraud

Fraudsters ask you to share an OTP or click “collect request” on your UPI app. Once you approve, money is debited instantly.

Important:

No bank or legitimate company ever asks for your OTP.

3. Fake Customer Care Numbers

When users search for support numbers online, scammers put fake numbers on websites. They pretend to help, but instead they install screen-sharing apps or ask for sensitive details.

4. Online Shopping & Marketplace Scams

Fraudsters create fake shopping sites or pretend to be buyers/sellers on OLX, Facebook Marketplace, etc. They use fake payment screenshots or ask you to scan a QR code to receive money (which actually deducts money).

5. Investment & Trading Scams

You may see high-return investment ads on social media promising “guaranteed profits.” These scams lure victims into sending money to fraudulent accounts or downloading fake trading apps.

6. Loan & Job Scams

Victims are asked to pay “processing fees,” “registration charges,” or “security deposits” for a job or loan that doesn’t actually exist.

How to Identify an Online Scam

Most financial scams share similar warning signs:

-

Pressure to act immediately

-

Requests for OTP, PIN, CVV

-

Payment links from unknown sources

-

Unverified apps or websites

-

Too-good-to-be-true offers

-

Grammar mistakes or suspicious URLs

If something feels off, trust your instincts and pause.

Why Choose Us

√ Quick Response & Reliable Guidance

Online fraud cases are time-sensitive. Every minute matters. We provide clear, step-by-step support so you know exactly what to do—without confusion or delays.

√ Expert Knowledge of Cybercrime Procedures

We understand how online scams work, how fraudsters operate, and how the official cybercrime reporting system functions. Our guidance is simple, practical, and based on real cases faced by victims across India.

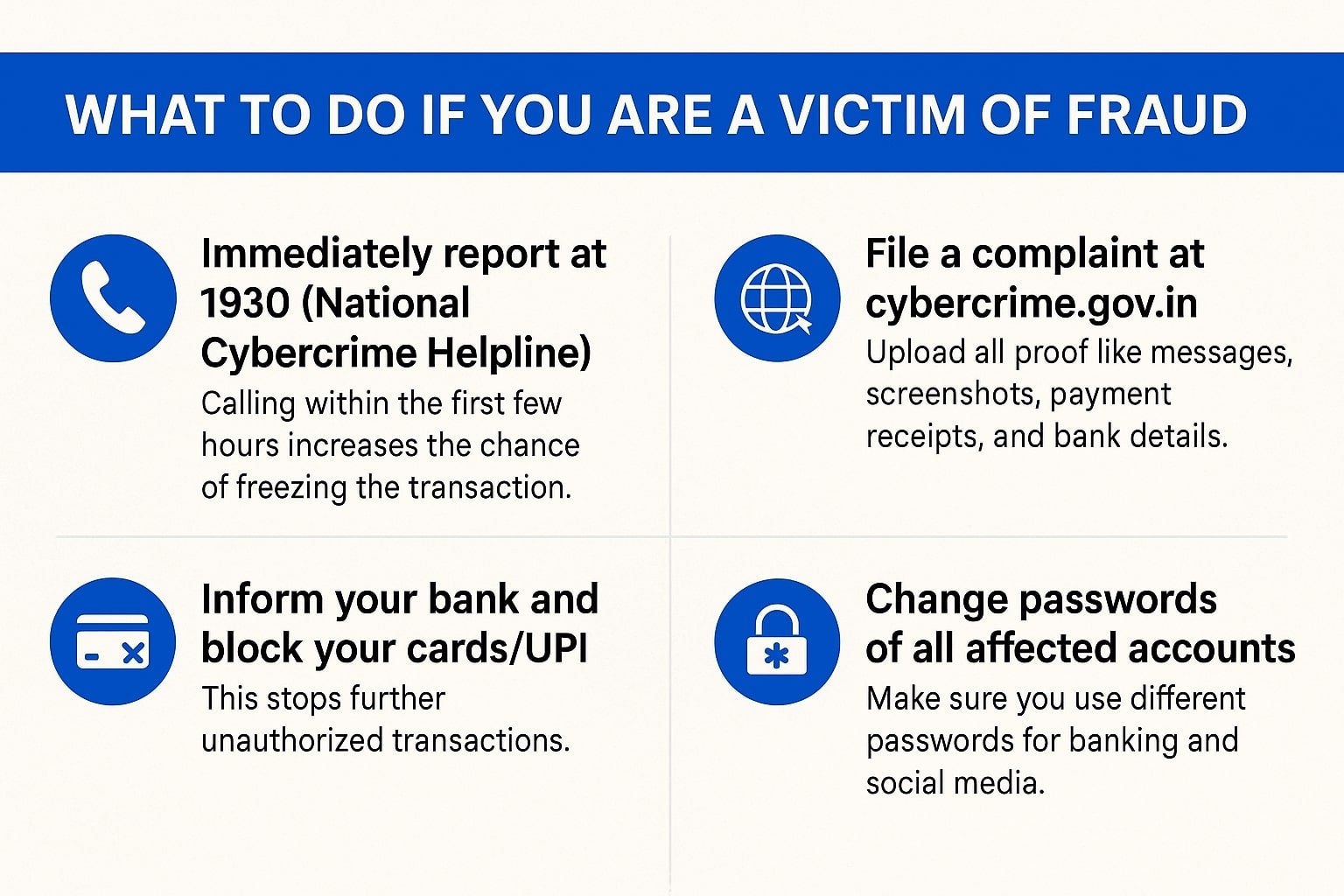

√ Assistance with 1930 & Cybercrime Portal Complaint Filing

Many people struggle with filing complaints or don’t know what information to submit. We help you prepare the right details so your case has a better chance of being processed quickly.

√ 100% Confidential Support

Your information, documents, contact details, and case history stay completely private. We maintain strict confidentiality in all interactions.

√ Easy-to-Understand Advice

Cybercrime doesn’t need to feel technical or overwhelming. We simplify everything for you—whether it’s identifying the type of fraud, collecting evidence, or reporting it correctly.

√ Awareness & Prevention Tips

We don’t just help you after a scam—we also guide you on how to stay safe online, avoid suspicious links, spot fake profiles, and protect your digital accounts.

√ Dedicated Help for All Types of Online Fraud

From UPI scams and phishing to investment fraud, shopping scams, OTP theft, loan scams, and more—we provide support across all major categories of cybercrime.

Why This Matters

Online financial fraud doesn’t just cause monetary loss—it affects mental peace, trust, and confidence in digital platforms. With increasing digital payments, staying informed is the best way to stay protected.

Your awareness today could save you—or someone you care about—from becoming the next victim.

Need Legal Help?

If you are a victim of cyber fraud, data theft, or online defamation, don’t wait. Early action can help protect your identity and recover your data. 📩 Contact Advocate Nitin Vashista for a Confidential Consultation 👉 [Call Now-9873678373] |